2015 Preview

Big Ten

A look at 10 key trends impacting providers in 2015.

- By David Kopf

- Jan 01, 2015

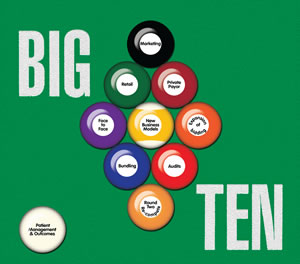

Each January, HME Business explores 10 key trends that will impact home medical equipment providers in the coming year. In the case of 2015, providers face several continued challenges in the Medicare arena, but they also have some clear opportunities to drive new revenues over the next 12 months. This year’s Big Ten trends are:

Each January, HME Business explores 10 key trends that will impact home medical equipment providers in the coming year. In the case of 2015, providers face several continued challenges in the Medicare arena, but they also have some clear opportunities to drive new revenues over the next 12 months. This year’s Big Ten trends are:

- The Round Two Re-compete

- Expansion of bidding

- Bundling

- Audits

- Face-to-Face

- Retail Sales

- Private Payor

- Patient Management & Outcomes

- Marketing

- New Business Models

Our goal with the Big 10 list is to give you a starting point for the next 12 months. The following summaries should help you line up how you want to approach each trend, and then take your best shot. Let’s explore:

Round Two Re-Compete

Competitive bidding has grown into such a juggernaut that it’s better to address the individual ways in which it will impact the HME industry for 2015. The first way is the Round Two re-compete.

Like in Round One, law dictates that CMS re-bid contracts under the Competitive Bidding Program every three years. In the case of Round Two, contracts for the previous bid expire on June 30, 2016. This means that CMS must re-compete Round Two, and that process begins in earnest starting this month.

As outlined in our this month’s “News, Trends & Analysis” section (page 8), the process began with registration for user IDs and passwords on Dec. 18, 2014, with a registration deadline for Authorized Officials of Jan. 6 and a Backup Authorized Officials of Jan. 20. After that, bids begin Jan. 20 and end March 25. Contracts won’t get announced until Spring 2016 and those contracts won’t be implemented until July 1, 2016.

In terms of geography, the Round Two re-compete will cover the same ground as Round Two’s 91 competitive bidding areas, but the Office of Management and Budget has slightly changed the coverage of some of them. In terms of product categories, the re-compete covers the same ground, ranging from general HME to NPWT to respiratory to standard power mobility. (Again, refer to “News, Trends & Analysis” for more information on geography and categories).

This means providers need to rapidly prepare for the re-compete, while at the same time they must help to advance the industry’s legislative efforts to reform competitive bidding. Those efforts are in a frustrating place at the moment: The industry worked hard to develop and advance the Binding Bids Bill, which aimed to require bidders to have special surety bonds forcing them to hold to their bid amounts. This addressed the major flaw of competitive bidding’s non-binding bids: that it lets companies engage in the sort of low-ball bidding at prices that some bidders have no intention of honoring. The surety bond forces them to live up to their obligation. Furthermore, the industry was able to obtain the Medicare Competitive Bidding Improvement Act, companion legislation in the Senate.

Unfortunately, both bills are poised to lapse with the 113th Congress. This leaves with the industry with a serious cliff-hanger for this month: Can providers and industry associations and advocates get that Binding Bids legislative language attached to anything moving through Congress before CMS starts bidding Round Two, or will we face another round of contracts subject to suicide bidding? The answer might be as frustrating as the question.

Expansion of Competitive Bidding

The next competitive bidding issue that the industry must contend with in 2015 is the expansion of competitive bidding. CMS is required by the Affordable Care Act to expand competitive bidding nationally by 2016. In November, CMS released its final rule that formalizes that expansion.

To begin with, there will be a phase-in process over six months, with allowables to be reduced by 50 percent of reduced amounts on Jan. 1 2016, and 100 percent on July 1, 2016. But the big issue has been rural providers. CMS’s original argument was that rural provider might see price cuts, but they won’t miss out on categories or geography. That might seem good in theory, until one considers that rural providers don’t have any kind of volume to make up for the reimbursement cuts that they will suffer.

Regardless of that concern, CMS will define rural areas as a postal zip code that has more than 50 percent of its geographic area outside of a metropolitan statistical area (MSA) or a zip code that has a low population density that was excluded from a competitive bidding area. The payment amount for those rural areas will be 110 percent of the average of the single payment amounts of all the areas where competitive bid prices are implemented. Many rural providers will be asking themselves if an extra 10 percent of a pricing model that most providers consider extremely flawed in the first place will be enough to carry their businesses. And if it can’t, then what happens to their rural patients?

Like any competitive bidding-related challenge, this means providers need to approach bidding expansion from both a business and an advocacy perspective. Is there anything the industry can do in 2015 to either work with CMS to reform how it will implement bidding expansion (and especially its reimbursement calculations for rural providers), or work legislatively to reform the expansion if CMS is not game to work with the industry, and, concurrently those providers impacted by the program must plan from a business perspective.

Bundling

Also, CMS will proceed with a limited version of its proposed bundling plan to phase-in the program. CMS will start with bundling for power wheelchairs and CPAP in up to 12 markets. The monthly bundled rate will include payment for all items and service, including maintenance of the equipment, and replacement of supplies. Comparative markets will be established to compare outcomes. For now, CMS will not move forward with bundling for oxygen, standard manual wheelchairs, enteral nutrition, respiratory assist devices, and hospital beds, per the industry’s recommendation.

But what does “move forward” mean? CMS hasn’t yet released the 12 markets to the industry, and how will CMS exactly bundle items. Moreover, when will CMS implement this “test” of bundling? It will likely begin with the Round Two re-compete, but how long will it last? There appears to be now hard timeline, at least not publicly. If CMS begins bundling for the 12 areas, will it start that bundling with the beginning of bidding or later in the process? How will bidders in those areas be alerted that they will be subject to bundling? Will they have enough time to calculate their bids based on that information? And for companies that operating across multiple CBAs, what will be the pricing structure across areas that are bundled and not? All these factors play into how HME businesses will bid in the re-compete, as well as conduct day-to-day businesses, but they have very little information to go on.

Ultimately, CMS’s plans for bundling represent a big box of unknowns that many in the industry would rather the agency simply not open.

Audits

If there is one factor in the Medicare funding environment that has nearly eclipsed the threat of competitive bidding, it is CMS’s audit program. Several yeas ago, CMS unleashed a tsunami of RAC, CERT and ZPIC audits on providers. After shaking off the initial shock, providers realized that audits weren’t going away, and that they would have to learn how to cope with those audits have learned how to educate their referral partners and work with them to ensure that claims have unimpeachable documentation. To respond to auditor questions and request, providers put into place tools and processes that let them respond quickly with the right documentation.

Providers learned their lessons well. So much so that they began appealing Medicare audits when it became clear that auditing contractors were trying to recoup claims based on technicalities and seemingly spurious grounds. In some cases, depending on the type of audit, providers were seeing as good as a 60 percent overturn rate when those appeals were elevated to the administrative law judge (ALJ) level.

But as providers grew increasingly adept at responding to and appealing audits, CMS increased the scope of its program. Over the past three years, the agency’s radically revved up audits have resulted in appeals growing by 184 percent. While CMS’s Office of Medicare Hearings and Appeals (OMHA) received 1,250 appeals a week in January 2012, it received more than 15,000 appeals a week by November 2013. This resulted in a backlog of 357,000 audit appeals by mid 2014. As a result Nancy Griswold, OMHA’s chief judge delayed assigning an Administrative Law Judge to any new audit appeals for more than two years.

This represents a huge problem for the industry. The problem with the ALJ delay is that the impact goes far beyond a simple delay. A recouped reimbursement does not sit in limbo sitting out the ALJ delay. Auditors and CMS continue to purse the provider for overpayments, or principle and interest via CMS’s Extended Repayment Schedule. And delinquency can involve the U.S. treasury.

The industry worked to try to reform the audit program to reduce the out-of-control system created for audit contractors, but it did not end well. Rep. Renee Ellmers (R-N.C.) and John Barrow (D-Ga.) introduced H.R. 5083, known as the Audit Improvement and Reform Act (aka, the AIR Act), into the House in order to address key problems with Medicare’s unchecked audit system. The bill aimed to boost transparency within the program; provide better education and outreach; and reward suppliers that have low error rates on audited claims with decreased audit exposure.

The bill did well, picking up 45 co-sponsors, but at press time looked poised to lapse with the 113th Congress. This means the industry will need to either attach that legislative language to other legislation moving through the House, or launch a new bill into the 114th Congress. In the meantime, providers will need to contend with a continued audit program and ALJ delay, while working to support the industry’s legislative efforts to bring the runaway program under control.

Face-to-Face

If there is one “known unknown” for 2015, it is Medicare’s face-to-face requirement. CMS implemented a requirement that a face-to-face evaluation with a physician must happen within six months prior to ordering frequently ordered DME items.

However, while the requirement was implemented, CMS has kept delaying the enforcement. In late 2013, CMS delayed enforcement of the face-to-face requirement until “sometime” in 2014, but recently CMS delayed enforcement indefinitely.

That open-ended delay happened in part because the volume of conflicting information and instruction from CMS and other sources resulted in pushback from other healthcare professionals, such as nurse practitioners, which resisted the face-to-face requirement, because it flew in the face of preexisting Medicare policy that governed their ability to order durable medical equipment items, such as wheelchairs and oxygen equipment as long as they have their own NPI. Even the sizable lobbying entity that is the American Medical Association has fought against the face-to-face requirement.

So the industry is left to wonder, is this a delay of the inevitable, and is CMS going to find a way to enforce face-to-face, or is CMS realizing what many healthcare organizations have been saying all along: the requirement is untenable? What is known the Affordable Care Act requires CMS to pursue the face-to-face requirement, but implementing requirement is looking not only unfeasible, but at least in the case of nurse practitioners flies in the face of law that governs nurse practitioners.

The frustrating part is that while the face-to-face requirement represents a massive unknown for 2015, if the requirement is enforced, then providers need to be ready. Fortunately, CMS has indicated that the face-to-face requirement will not be applied retroactively once the delay is removed, but claims can still be audited. This means that providers must have procedures in place to comply with the requirement. They must implement a protocol within their company requiring a copy of a face-to-face encounter and written order prior to delivery WOPD for specified items listed in the face-to-face rule. (For more detail on this, read “Face-to-Face: Are you Ready?” on page 14.)

Ultimately, the best strategy for dealing with face-to-face in 2015 is to comply with a policy that might not see enforcement over the next 12 months — or at all. That’s a frustrating proposition, but as already seen providers fare better with Medicare if they err on the side of caution.

Retail

Retail remains king when it comes to new revenue for HME providers. At a time when Medicare programs such as competitive bidding are engaged in slash-and-burn reimbursement cuts, providers have sought new ways to reinforce their cash flow. That’s where retail sales have come into the picture. Retail sales offer an excellent way to accomplish that, because they are simple cash transactions that don’t involve Medicare, private payor insurance carriers or anyone else. The provider and the patient are engaged in a simple retail exchange.

Retail sales items appeal to a wide variety of patients with an equally wide variety of needs. For instance, bath safety items, home access products and aids to daily living offer a wide variety of appeals to patients ranging from seniors to bariatric patients to mobility patients. These opportunities leverage both the provider’s product knowledge and patient relationships.

And this lets providers reach out to their patients in new and creative ways. Throughout 2015, we can expect to see providers ramp up their marketing efforts with more effective, targeted appeals. They will need to consider the appeals that resonate with the different segments of their customers and patients, and determine which venues — print, social media, email, web, print, and even TV and radio — will spread awareness and drive interest and traffic to the store. (See “Marketing” for more on this.)

Once those patients get to the store, providers must be able to create a “retail experience” for customers and patients. When clients come to the providers’ retail location with cash sales in mind, they are expecting an experience that differs from that of a funded patient. A funded patient comes to the provider with a prescription and set expectations. A cash sales customer is looking for options, information and a range of solutions that can help make an informed purchase.

So, providers will increasingly need to display product in ways that attract and engage; use point-of-purchase displays to drive increased transactions; use solid signage to attract buyers to new offering, direct clients to items they are looking for; and maybe get them to consider goods they might not have had on their shopping list. Fortunately, vendors are already helping providers with resources and expertise that help them ramp up their retail game. But it doesn’t stop on the show floor. Providers might even need to consider all new retail locations. As a result, the coming 12 months could see site selection become an increasingly important issue, as well.

Private Payor

Another key to driving new revenue is private payor insurance. Providers are already tapping into this increasingly important alternative revenue source given that CMS has continued to reduce Medicare reimbursement in every way possible. And, private payor is an arena where many providers have already done business. Now they are simply ramping up their game in a known arena Where several years ago, providers might have not paid much attention to private payor insurance revenue, now they are giving it the time it deserves.

But as familiar as private payor insurance is to providers, it is no a slam-dunk. Let’s not forget that private payor insurance carriers tend to set their rates based on Medicare reimbursement, and increasingly are auditing claims and demanding repayments. And in a move similar to Medicare’s efforts to reduce the number of DMEPOS providers via competitive bidding, there are some private payor carriers that have attempted to enter into single-provider relationships with large national HME providers, as they try to drive down their cost structures which makes the landscape that much more difficult. That said, it is also likely that those larger national providers will look to subcontract services for certain categories and geographic areas. However, these single-provider deals have produced mixed results, and the practice could be on the wane. (If only CMS would pay attention to such trends…)

Regardless of whatever challenges the private payor insurance market presents, it is an undeniable source of alternative revenue that providers must continue to pursue. So providers must ensure that their billings and claims, referral sales, delivery and support departments are all up to the task. Moreover, providers must ensure that they have the right accreditation for each of the private payor plans they wish to serve so that they adhere to the right billing protocols, policies and procedures.

And from a sales perspective, establishing solid relationships with private payor insurance carriers will require providers to do some higher level deal-making that they might have previously conducted in referral partner sales efforts. Now the management and ownership level will need to participate in the practice. They will also need to involve a larger sales team for such deals, that involves care and product experts. Likewise, their marketing efforts will need to be more highly targeted to their potential partners as well. Suffice it to say, 2015 will see a much higher-level and higher-touch effort on the part of the home medical equipment industry’s efforts to make broader, more strategic deals with private payors.

Patient Management

An undeniable U.S. healthcare trend is the increasing focus on driving optimal patient outcomes. Medicare’s effort to foster Accountable care organizations (ACOs), which are groups of healthcare providers that provide end-to-end healthcare solutions that focus on optimizing patient outcomes for the lowest price, is case in point of this trend. Medicare established guidelines establishing ACOs in the 2010 Patient Protection and Affordable Care Act. The Act lets CMS set up the Medicare Shared Savings program, which lets it extend contracts to ACOs to provide services to Medicare Part A and Part B beneficiaries. In terms of number, Medicare has reported that there were 32 ACOs in December 2011; 27 ACOs in April 2012; 88 ACOs in July 2012; and 106 in January 2013. All told, there are nearly 350 ACOs across the country.

This speaks to a larger trend: If Medicare continues to set the state for the rest of healthcare, it is likely that healthcare professionals throughout the healthcare continuum will look for partners who can help them ensure the best outcomes for the best price. And this provides HME businesses with a key opportunity: if they can create services that help better manage the care patients receive, then they will position themselves as a key player in the healthcare process.

This is where patient monitoring and management fits in. Using a variety of communications methods and remote monitoring innovations, providers serve as an information conduit to the physicians and other sleep professionals involved in the patients’ care. In this regard, the sleep market has gained considerable ground in patient monitoring and management are sleep providers. There has been an imperative among sleep providers to provide systems that let physicians and other health professionals involved in the patient’s care remotely monitor the patient’s progress, and tweak the therapy as needed. These systems started out as data cards that would be reviewed later, after submission, but now, thanks to technology, sleep providers can offer systems that let doctors monitor patients that day.

This idea can be extrapolated beyond sleep. Physicians are busy people who want results from their partners. By working with the physician, the provider can set thresholds within the monitoring system. This means that the doctor can go about his or her business and be alerted by the provider when there is an event. Through a blend of automated and live communications methods, physicians can consult with patients and even ensure they are complying correctly.

So, by implementing monitoring and management systems, providers can leverage these strategies and technologies to position themselves as lynch pins in ensuring optimal outcomes and cost models for patients and partners, alike. That can translate into entirely new services in which the provider is delivering vital management information for other patient groups to physicians. For example, providers of therapeutic support surfaces and wound care could drive all new business models by regularly checking with patients to ensure wounds are healing and that therapeutic support surfaces are doing their job. Or diabetic supply providers could handle the busy work physicians spend on collecting and monitoring blood-glucose data.

And this makes good business sense. Besides helping ensure outcomes, patient management can help providers maximize the business they are getting from each client. Each time a patient experiences an event, the provider can contact the patient to find out what happened, reported information back to the physician as quickly as possible, and leverage that dialog an opportunity for the provider to drive new business through resupply and related-item sales. For strategic thinking providers, patient management could mean increased revenue from multiple angles.

Marketing

As retail sales rise in importance when it comes to the bottom line at many HME businesses, providers will need to greatly sharpen their marketing game. They will need to infuse their patient-directed marketing efforts with clever, compelling marketing messages that get those patients to come into the retail location. But it doesn’t stop at bricks and mortar. Prompting customers to visit their online storefronts will be just as important. Patients are increasingly checking out DME items online before they even walk into the store. This means that providers need to ramp up their marketing skillset and start thinking both creatively and strategically, when it comes to retail marketing.

A key component of that strategy will be value marketing. Value marketing is a technique in which a business provides useful content and information to its existing and prospective customers on a regular basis. It can come in the form of emails, blog posts, print newsletters and similar delivery methods. But the key is to provide regular benefit so that the recipient will equate your business with that value.

This is a prime opportunity for providers, who have developed considerable expert product, healthcare and clinical expertise and information over the years. So, they simply need to share bits and pieces of this knowledge in order to drive that value marketing. During 2015, providers must develop marketing communications campaigns that provide customers useful health information while highlighting your branding and contact information. This way, every time providers make a marketing impression with these campaigns, customers will associate that value with their brand.

Clearly, social media will be critical in expanding the audience for that value marketing. Social media has almost redefined the way people communicate and interact with each other and businesses. In terms of marketing, it offers providers a unique opportunity to not only communicate to clients, but engage with them. If they haven’t already, providers will need to become masters of social media in the New Year in order to drive not only your value marketing, but also special sales events, or simply share interesting links and third party information they might enjoy or find useful. This makes them more engaged members of a home medical “community” that includes their patients, caregivers, referral partners and others.

Connecting online is only one part of the marketing equation for 2015. Providers will need to strive to make in-person connections, as wells. Direct, public outreach will be just as important. In the same way providers offer their referral partners in-services, providers should host special seminars on their areas of expertise at various locations through the month. Their events could hit local senior living centers, libraries or hotel meeting rooms. Moreover, providers should target public community fairs, health conferences or similar public events throughout 2015 that would attract the consumers they want to reach, and try to get involved in each.

New Business Models

But cash sales can’t carry it all. While retail sales will be critical in maintaining provider cash flow, it is not a panacea for all Medicare-related funding setbacks and other trends impacting the home medical equipment space.

Looking at these factors, it is clear that providers will need to radically reshape their businesses in 2015 so that they can reach new markets.

What the declining Medicare market and increased effort to pursue avenues such as cash sales and private payor has taught us is that provider will continue to evolve into more unique businesses with business models that tap into varied revenue sources. Providers are taking their strong suits — patient knowledge, product knowledge and care knowledge — and look at their local patients, care providers and health plans to find the customers that will appreciate their expertise. And those customers might not fit the traditional home medical equipment mold.

These models will make matches between patient knowledge and product knowledge to serve customers that HME providers might not have considered before. For instance, working to supply residential care and other facilities-based providers with a variety of durable medical equipment is a perfect example of how a provider could bring that varied expertise to bear in an entirely new venue beyond the home.

Other new business models could greatly hinge on a specific product expertise. For instance, providers specializing in wound care and therapeutic support surfaces could expand into that would help them build off of existing business relationships with physicians, as well as tap into new business relationships with facilities such as wound centers. This would let them extend not only their core offerings in those categories, but special and related offerings, such as NPWT, enteral nutrition, compression, support surfaces, and of course dressings.

And, of course, new models could take place in the home. For instance providing home care services for seniors and other patient groups could be a perfect way to expand on providers’ existing patient relationships. And if there is already a group of established players delivering those kinds of services in a provider’s market, then that provider should consider creating a business relationship between the two.

This article originally appeared in the January 2015 issue of HME Business.