Respiratory Survey 2013

Respiratory Obstacle Course

Fourth annual respiratory therapy survey shows that industry barriers continue to hamper RTs' future.

- By Joseph Duffy

- Mar 01, 2013

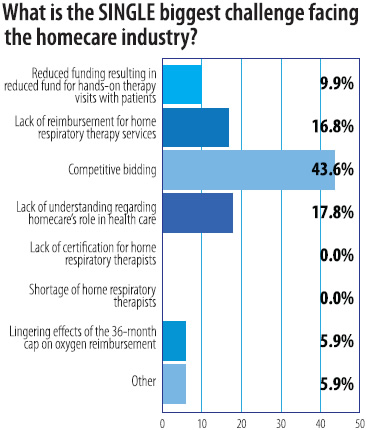

Without much surprise, results of RSM’s Fourth Annual Respiratory Survey shows that competitive bidding is once again the single biggest challenge facing the homecare industry. Competitive bidding has staked this infamous claim three years in a row, with 43.6 percent of respondents pointing a finger at competitive bidding this year, compared with 43.9 percent from last year and 33.1 percent the year before. Coming in second with 17.8 percent of respondents was lack of understanding regarding homecare’s role in healthcare. Right behind that with 16.8 percent of respondents was lack of reimbursement for home respiratory therapy services.

Without much surprise, results of RSM’s Fourth Annual Respiratory Survey shows that competitive bidding is once again the single biggest challenge facing the homecare industry. Competitive bidding has staked this infamous claim three years in a row, with 43.6 percent of respondents pointing a finger at competitive bidding this year, compared with 43.9 percent from last year and 33.1 percent the year before. Coming in second with 17.8 percent of respondents was lack of understanding regarding homecare’s role in healthcare. Right behind that with 16.8 percent of respondents was lack of reimbursement for home respiratory therapy services.

“Competitive bidding is not the only problem the industry faces,” said a survey-taker. “This makes it more difficult for all of the problems to be addressed in a timely manner. We have closed five of six stores in order to keep a core business alive, and really have no where else to cut.”

Who are the respondents?

This year’s survey respondents were polled from all over the United States, with 39.5 percent coming from the Midwest, 29.5 percent from the South, 21.7 percent from the East and 9.3 percent from the West. More about the survey respondents:

- 62 percent have RRT certification, 34.8 percent have CRT and only 1 percent has AE-C.

- 76.9 percent have 15 years or more as a respiratory therapist, while 1 percent has less than two years.

- 49.5 percent have 15 years or more as a respiratory therapist in the homecare setting.

- 31.6 percent devote from 26 percent to 50 percent of their time to oxygen therapy.

- 29.6 percent devote from 50 percent to 75 percent of their time to sleep therapy.

- 41 percent devote less than 10 percent to asthma therapy.

- 56.6 percent devote no time to ventilation therapy.

- 99 percent recommend or approve products.

- 28.8 percent select all products for purchase.

More about Competitive Bidding

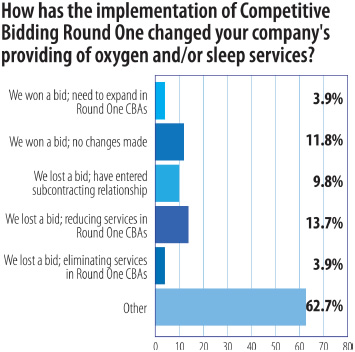

The majority of respondents, 46.5 percent, are located in a competitive bidding area for Round Two; 11.6 percent are located in a Round One location, and 41.9 percent are not located in a competitive bidding area. Of those located in a Round One bidding area, 45.1 percent were Round One bidders, of which 63.6 percent did not get offered or accept a contract.

For Round Two, 61.9 percent of respondents bid for oxygen services and 60.6 percent bid for sleep services. The majority of Round Two bidders (39.5 percent) say they are somewhat confident that they will win a contract. Only 2.6 percent are extremely confident, where 22.4 percent are not confident at all.

The majority of respondents who are bidding in Round Two (60.5 percent) say they devised contingency business plans if unable to secure a Round Two contract. Respondents’ brief descriptions of their contingency plans include:

- Our company has dropped most respiratory services, focusing on retail non-insurance transactions.

- Hopefully we will be absorbed by one of the winners, or become strictly retail.

- We will lay off 20 percent of our personnel.

- We will continue ventilator programs and advanced respiratory services, contract oxygen, and refer out sleep.

- We plan to change our product mix to a more patient-centric model, increase our retail component of business, and eliminate as many deliveries as possible via new oxygen technology.

- Do more business with the VA, GSA contract, and retail.

- Open a retail store to attract more cash business, as well as contract more private entities for DME business.

- We are a large hospital system respiratory-only DMR company. We are working on establishing “group” appointments using two RTs to set up six patients at a time in a two-and-a-half- to three-hour time span. We just created a PAP video, which is viewed by patients before their appointment and will eliminate the RT’s initial education before setup. This makes us more efficient and increases productivity.

The industry’s attempt to improve the way that Medicare pays for DMEPOS benefits is called the Market Pricing Program (MPP), a bill (H.R. 6490) now in committee. It has given the industry some hope that it could replace the competitive bidding model. When asked if the industry will be able to stop competitive bidding, either through repeal or replacing it with the MPP, before competitive bidding is implemented this summer, 44.1 percent of respondents said that it was not very likely. Only 2.5 percent said they thought the industry would stop competitive bidding before implementation.

“Our industry has done a poor job letting Congress and others know just what we have to do to get paid for our services,” says a respondent. “They have no idea that we must employ 30 percent more employees to jump through hoops just to get paid Medicare. They have no idea that we only end up with 80 percent to 85 percent of what we bill due to more stringent regulations and audits.”

Patient Care

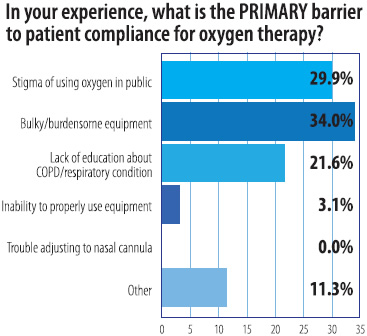

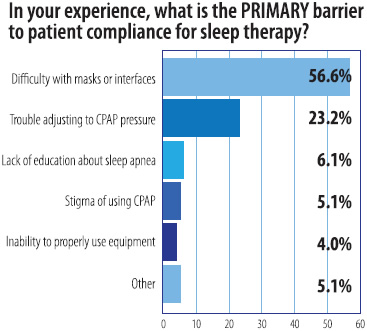

Funding cuts, caps and competitive bidding add pressure to HME providers trying to find ways to solve patient compliance and standard of care issues. To address or improve patient compliance, respondents are making follow-up calls to patients (82.8 percent), making follow-up visits to patients’ homes (57.6 percent), distributing product literature (54.5 percent), participating in patient support groups (20.2 percent), and hosting in-house meetings about equipment or medical diagnoses (12.1 percent). Respondents name bulky/burdensome equipment (34 percent) as a primary barrier to patient compliance for oxygen therapy, and difficulty with masks or interfaces (56.6 percent) as a primary barrier to patient compliance for sleep therapy.

A respondent said, “One barrier we see more and more is the inability of patients to properly use the equipment because they are not in the proper environment. We see many people in a home setting who are early onset dementia and have family members who find the decision to deal with moving a parent into assisted or SNF facilities too difficult to make. They want to see their elderly parents spend their final days in the home they have known for so long but it isn’t always in the best interest of the patient. I’m not critical because we had to go through this same situation with my mother, but people need to somehow be taught that this decision-making process is now their responsibility for their aging parents, just as their parents were responsible for decisions for them when they were young.”

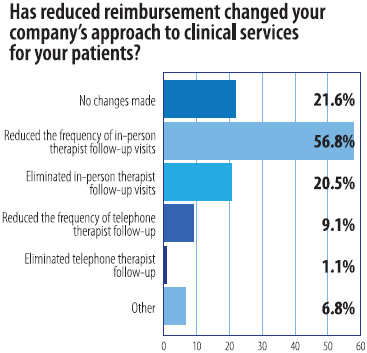

According to the survey, a majority of respondents (56.8 percent) have reduced the frequency of in-person therapist follow-up visits due to reduced reimbursement, where 21.6 percent have made no changes and 20.5 percent have eliminated in-person therapist follow-up visits all together.

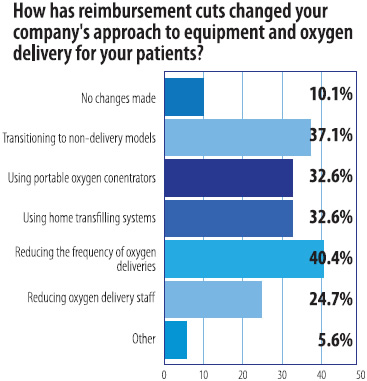

Regarding equipment and oxygen delivery, 40.4 percent of respondents have reduced the frequency of oxygen deliveries due to reimbursement cuts.

Capping it off

Finally, where 12.7 percent of respondents last year called the oxygen cap the single biggest challenge facing the homecare industry, this year, the oxygen cap fell to 5.9 percent. As of January 1, 2013, 16.9 percent of respondents said that 26 percent to 30 percent of their oxygen patients have reached the 36-month reimbursement cap. Last year, 15.7 percent of respondents said that 21 percent to 25 percent of their oxygen patients had reached the 36-month cap.

This article originally appeared in the Respiratory & Sleep Management March 2013 issue of HME Business.